INternet Service Providers and Peering (v2.9)

With Whom to Peer?

If peering makes sense from a technical and financial perspective, the next question is, “With whom should we peer?” To identify potential peers, ISPs use a variety of criteria.

Quantities of traffic distributed between networks often sets the pace of the negotiation; to quantify this, ISPs may systematically sample inbound and outbound traffic flows. Flows then are mapped to originating AS, and calculations are made to determine where peering (direct interconnections) would most reduce the load on the expensive transit paths. There is substantial work involved here, as this traffic sampling results in a large number of data. Alternative measurement methods include measuring port statistics.

Many peering coordinators indicated that peering selection is accomplished by intuition. Their sense was that they knew where traffic was and would be headed.

In either case, the end result of this first phase is list of the top 10 ISP candidates for peering. Interviews with Peering Coordinators highlighted a few other considerations.

Broader business arrangements between ISPs may circumvent the peering negotiation phase and expedite discussions directly to Phase III, the peering methodology negotiation phase.

Peering policies range across a wide spectrum from “open peering policy” meaning “we will peer with anyone”, to “if you have to ask, we won’t peer with you.” Peering policies are often exposed only under Non-disclosure agreements, and these policies reduce the number and type of ISPs that are peering candidates.

In many cases peering requires interconnections at multiple peering points, explicit specifications for routing, migration from public (shared switch) peering to private (non-shared switch) peering after a certain traffic volume is reached, etc. It is beyond the scope of this document to fully explore the technical and political motivation for peering policies; it is sufficient to be aware that these discussions can be cumbersome and require a combination of technical and financial negotiation.

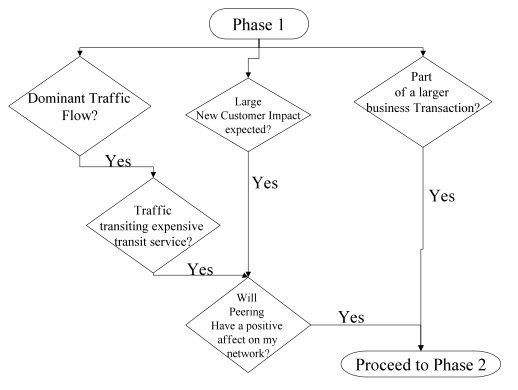

The greatly simplified peer qualification decision tree looks something like this:

Figure 5- Phase 1 of Peering Selection Decision Tree

Once the measurements have been made and analyzed, and it appears to be beneficial to peer, the ISP enters into Phase 2, Contact & Qualification, Initial Peering Negotiation.

Emerging Migration Path from Transit to Peering. Interviews with tier 2 ISPs highlighted an emerging peering transition strategy:

1)Access the Internet via transit from a global provider,

2)Pursue peering arrangements on public switches at exchange points to reduce load on transit links and improve performance

3)Migrate high traffic public peering interconnections to private interconnections (via fiber or direct circuits).

4)Ultimately migrate traffic away from transit purchase and negotiate (free or for-fee) peering with former transit provider.

To illustrate this path, consider Telia, a global ISP based in Sweden. Telia analyzed their transit costs and recognized that approximately 85% of their traffic at MAE-East was to their transit provider and the remaining 15% was through peering relationships. By focusing on establishing peering relationships with the top 25 destination ASes they shifted the mix to 70% through private peering at an exchange with the remaining 30% of traffic heading toward their transit provider. The result was increased traffic efficiency and a reduction in the cost of transit.

It should be stated that phase four of the migration strategy listed above may be overly optimistic and/or challenging for several reasons. First, transit providers prefer paying customers to peers. Second, transit providers typically have much more ubiquitous network infrastructure than their customers, and therefore will not see their customers as equal contributors. Finally, the transit providers have an incentive to reduce the number of their own competitors.

To illustrate this migration path, Raza Rizvi (REDNET) said “We had to leave our upstream provider for 16 months with alternative access to their route before they considered us not as a customer lost but as a potential peering partner.“

After the top 10 potential peers are identified, peering coordinators proceed to Phase 2: Contact & Qualification, Initial Peering Negotiation.

Phase 1: Identification and Qualification

Acknowledgements