The Global Internet Peering Ecosystem

Broadband Access Providers

Around 2002, Cable Companies in North America were forced to abandon their upstream Internet Service Provider, @Home. They had only 30 days to establish multi-gigabit-per-second transit relationships with Tier 1 ISPs! (Back then this was a lot of capacity.) After some initial analysis, they found that about 40% of this Cable Company traffic is Peer2Peer traffic, and ultimately destined for other cable companies.

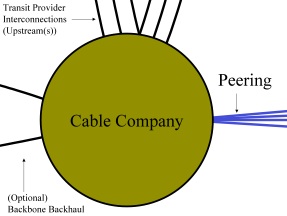

Figure 13 - Broadband Access Provider Model (Cable Company in this case)

Since so much traffic was exchanged between the cable companies, they decided to migrate into exchange points to peer that traffic with each other. While at the IX they peered openly with just about anyone - demonstrating an Open Peering Inclination.

Most of the Cable Companies peered their Peer2Peer traffic with one another to reduce their transit expenses. This change represented a significant change in the Peering Ecosystem because:

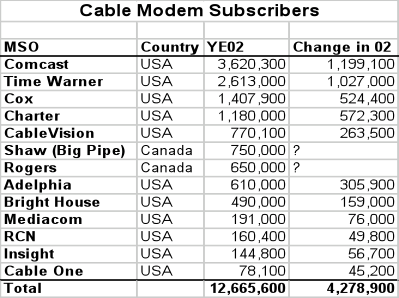

The volume of traffic back then being directly exchanged in peering relationship was in the Gigabits per second, second only to the Tier 1 ISPs traffic exchange volume estimates at the time. The aggregate number of North American Internet Cable Subscribers was about 12 million as shown in the table below.

Until 2005 or so, Cable companies generally had an Open Peering Inclination or a No Peering inclination. The cable companies were not generally interested in selling transit to ISPs or Content Providers, and they generally worked in non-overlapping regions so they don’t compete against each other. As a result, there was no economic disincentive for the cable companies to peer with each other, the Tier 2 ISPs, or the Content Providers. Those with a No Peering inclination simply paid for transit from a couple Tier 1 ISPs.

Currently, most of the Cable Companies have a Selective or a No Peering Policy. The migration from Open to Selective has been gradual and apparently the result of scaling issues and business motivations. Decisions that used to be made by the Internet Engineering teams are now made by a broader that takes into account the business implications of accepting a peer. The controversy surrounding the “Net Neutrality” debates make the once open cable companies much more tight lipped about discussing these peering issues.

The Kazaa Effect. The typical ISP sinusoidal demand curve was replaced with a flatter demand curve with Peer-2-Peer file sharing software on the Cable company networks. Peering with each other allowed the cable companies to offload this traffic from their transit connections (which they pay for) onto free peering interconnections.

Another interesting effect, originally noted by Eric Troyer (formerly of CableVision) showed that empirically Peer-2-Peer traffic volume grows when the cable companies peer with each other. Peering causes Kazaa to prefer to fetch files across the recently peered network path. The Kazaa selection protocol uses latency to determine which Kazaa file sharer is “more local”, and automatically selects that file sharer. The result is that when Cable Companies (or any access heavy companies for that matter) peer with each other, they can expect an immediate 20% growth in Kazaa-based peering traffic volume.

Sidebar: A related Kazaa story involves a grandmother in Australia that had her grandkids over during the holidays. In Australia, end users are charged for Internet access on a per-Megabytes-downloaded basis. When the grandkids wanted to hear the latest Britney Spears song on grandma’s computer, they installed Kazaa and downloaded the song. By default Kazaa shares all files it downloads, and soon grandma’s computer became the preferred source for the Britney Spears songs! Grandma’s bill from Telstra was several hundred dollars as opposed to the usual $25 she pays per month! In the U.S. where broadband is typically a flat fee there is no such disincentive to use all the bandwidth available.

Other Broadband Players. RBOCs and many of the DSL Providers sell transit to other companies in the Peering Ecosystem, and therefore may have a disincentive to peer with them. They look a little different from the Cable Companies who sell transit but on a flat rate basis.

What a Broadband Access Provider looks like

Broadband Access Provider Motivation

Broadband Access Provider Behavior

Internet Region

P

P

P