My Blog

Q: DrPeering -

Level 3 and Comcast. Who do you think wins and who loses?

Paul Weston

A:

Paul -

The Comcast - Level 3 dispute is an interesting power play. I describe the maneuvers below and I think you will find that both sides have a reasonable position. As I see it, this case effectively spotlights a failure in the peering paradigm - there is no agreement on the notion of "an Equal Value relationship".

Consider the following sequence of peering maneuvers.

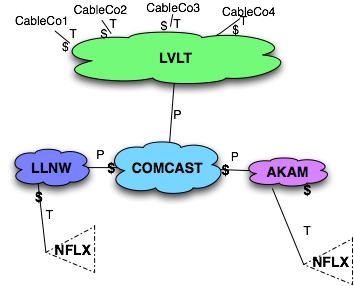

1) Starting state.

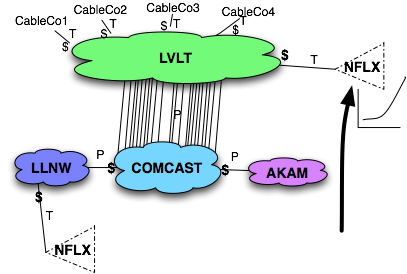

Comcast has negotiated a complex business arrangement where Level 3 bundles paid services (such as fiber and Internet transit) with settlement-free peering - the free and reciprocal exchange of access to each others customers. Since most cable companies in North America use Level 3 for transit, this allows Comcast to get free access to the other cable companies. This would including settlement-free peer-2-peer for example since this is eyeball to eyeball traffic, as well as free access to Level 3’s content providers.

(For clarity I have called the cable companies CableCo1-4 in the diagram below.)

Level 3 is a Tier 1 ISP in the U.S. Internet Region since, by definition, they have access to all routes in the U.S. solely via their settlement-free peering arrangements.

Netflix experiences exponential growth and uses Akamai and LimeLlight (maybe others) for delivering videos to the access networks including Comcast.

Who wins?

In this starting state, Akamai gets $T/Mbps in CDN fees with a cost of $P/Mbps in paid peering fees to Comcast. As Netflix experiences exponential growth, Akamai gets exponential revenue as does Comcast. Life is good for Comcast and Akamai.

But Netflix wants better pricing.

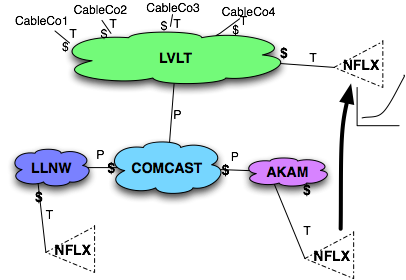

2) Level 3 undercuts Akamai and gets the NetFlix business.

It makes sense that Level 3 can undercut Akamai. Level 3 has most of the cable companies on-net and they are paying Level 3 transit fees to access the global Internet. Level 3 has settlement-free access to Comcast, and Level 3 has plenty of fiber and backbone. Level 3 can make money from Netflix and make money from the other cable companies while simultaneously not having to pay Comcast anything. Netflix traffic shifts to Level 3 as shown below.

So who wins?

Winner: Level 3.

What should be obvious is that Level3 wins big with this deal because they get transit fees from both sides of the network! They get exponentially growing transit fees from Netflix, and they also get paid by the access networks (other than Comcast) that request this exponentially growing Netflix video traffic. And as with most Tier 1 peering agreements, the traffic that doesn’t originate and terminate on their network is offloaded settlement-free via peering relationships.

Loser: Akamai and Comcast.

Akamai in loses the transit revenue and more importantly, the exponentially growing transit revenue. Comcast similarly loses on the paid peering revenue from Akamai. Further, Comcast loses because it still has to carry this exponentially growing traffic volume across its network.

3) Adjustments Required - More points of Interconnect

Most peering policies we studied (including Comcast’s Peering Policy and Level 3’s Peering Principles) in “A Study of Peering Policies” have clauses about updating the bandwidth between peers as needed.

Most peering disputes in the past have been resolved by both parties agreeing to interconnect in more places, and this is precisely what Level 3 proactively recommended to Comcast in advance of the new Netflix customer traffic coming on-line. Giving a ‘heads up’ is something that good peers do for each other.

Here again Comcast Loses

Comcast loses here again because Level 3 was asking for a couple dozen additional points of interconnection, a potentially large and growing burden on Comcast’s network. These ports might otherwise have been allocated for paid-peering, a revenue generating activities. With this model, the more Level 3 wins CDN business, the more Comcast loses.

This sequence highlights some problems with the Internet Peering paradigm today.

The Problems with Peering Today

What makes this situation so interesting is that the spotlight is on the elusive peering “exchange of approximately equal value.” What is the value derived from peering and how does one objectively calculate its value?

Here are some of the problems with the peering paradigm as highlighted in the scenario above.

-

1)The Ecosystem Revenue-Costing Model is Broken. Comcast will bear the burden of carrying the Netflix traffic without corresponding revenue to help fund operations and the upgrades needed to support the traffic. As a Stanford professor once told me, “The fundamental flaw with the Internet architecture is that there is no standard way for the dollars to flow to where the bottlenecks are.” With the absence of a business-rational motivation to upgrade, a rational business will not invest.

-

2)Free Peering beats Paid Peering. Comcast has CDNs like Limelight networks and Akamai paying paid peering fees to get their content topologically close to the eyeballs, and Level 3 does not. This allows Level 3 to have a lower cost structure and allows them to undercut the other CDNs in the market. Free peering provides an unfair advantage against those who have a paid peering relationship.

-

3)No Choice to reach Comcast Eyeballs. Practically speaking, there is no alternative path to the Comcast eyeballs but through Comcast. There are only two paths to Comcast customers. One can reach Comcast through its paid peering service (Level 3 calls these “Toll Roads” for a better performing path to the eyeballs). Or one can reach Comcast customers through a transit path that will necessarily be longer, higher latency, and more prone to performance issues than the direct paid peering path to the Comcast eyeballs. If you are a CDN, your business is getting the customer content as close as possible to the eyeballs, so you really don’t have a choice but to pay for Comcast metered paid peering.

It is easier for Netflix to change CDN providers than for the 100’s of millions of Comcast subscribers to change access providers. Comcast eyeballs are captive.

-

4)Level 3 could fall from Tier 1 ISP Status . If Level 3 pays to reach any destination in the U.S. Internet Region, then, by my definition, Level 3 ceases to be a Tier 1 ISP. They would join the Tier 2 ISPs looking for a way to bypass or slow the transit/paid peering meter. The perspective of the other Tier 1 ISPs might change to be, “well if Comcast can extract revenue for this large volume of asymmetric traffic, maybe I can as well.” And the de-peerings might tumble in like dominoes as they did with ICG after the first Tier 1 ISP (Sprint) de-peered them. (There was a talk at the Gigabit Peering Forum at the Hayes Mansion in San Jose a few years back describing this rapid succession of depeerings). Maybe this is different because Level 3 won’t appear behind a transit provider, but this is a step backwards for Level 3 to be sure.

Fundamentally, these maneuvers applied tension to the foundational notion that peering is based on an “Equal Value” relationship.

Comcast strategically chooses peering ratios to define “Equal Value” relationships. It is an eyeball heavy network and one would expect the eyeballs to pull down traffic off of the Internet. Peering Ratios allows Comcast to say “If you push traffic to my eyeballs, you pay.”

Level 3 and other large ISPs strategically use the phrase “similar scale and scope” to define “Equal Value” relationships. Building into as many locations with a similar capacity would certainly narrow down the number and type of “equals”, putting Level 3 in the driver’s seat.

By these discriminators, Level 3 fails Comcast’s test and Comcast fails Level 3’s test for peering. What is really happening here is the two parties are playing chicken and the issue is the money.

Other Sources

Level 3's Lower Cost Comes From Owning The Network, Not Free Peering

The Real Story Behind the Comcast-Level 3 Battle

http://gigaom.com/2010/12/01/comcast-level-3-battle/

Peering Disputes: Comcast, Level 3, and You

http://www.voxel.net/blog/2010/12/peering-disputes-comcast-level-3-and-you

Eliquatuero at diput tiros numsan vent la, conum dolesed zzrit la biam iure nonsen de sevelit exeril utaduit te facip eugait lametue consecte dolesed etain ton dolor sevelit etin vern adionse magnisc lorem numsan.

Comcast vs Level 3

Thursday, February 10, 2011

Comcast says: “Applicant must agree to participate in joint capacity reviews at pre-set intervals and work towards timely augments as identified.”

Level 3 says it seeks interconnection with a peer that “Has the capability, processes and tools to assure a high degree of network performance, upgradeable capacity, full diversity and robust security”.

(BTW Level 3 - I think you mean ‘ensure’. Assure is something you do to a person, and ensure is something you do “to guarantee and event or condition.“ )