LastModified: May 17, 2005

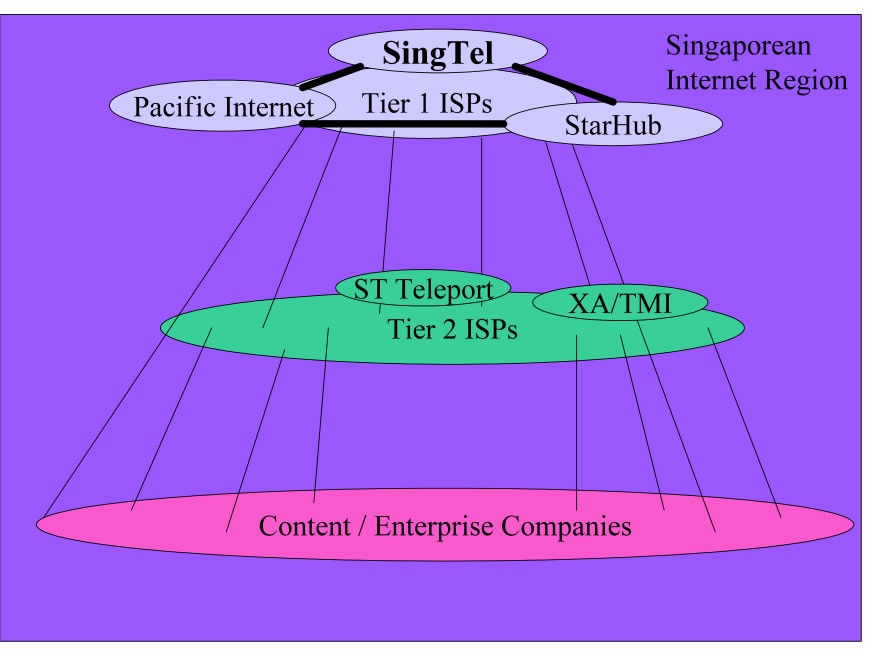

Figure 1 - Peering Ecosystem Diagram

Definitions. Within each of these Internet Peering Ecosystems we find at least three categories of players:

These rough classifications and definitions are important because they help us both

The Tier 1 ISPs in this Peering Ecosystem include

who collectively sell access to all routes in this ecosystem.

SingTel is the incumbent state-owned telephone company that still connects the largest set of telephone and Internet customers and is considered the 800-pound gorilla among the Tier 1 ISPs in Singapore . Singapore is called “Business Friendly” by Microsoft, which listed this as one of the drivers to make Singapore the core distribution point for all Microsoft content across Southeast Asia . One example of this “Business Friendly” environment is that the tax rates in Singapore are closer to 10% as compared with Tokyo at 40%. Singaporean Government Proactive on Telecom Reform. The Singaporean government is proactive in deregulating the Internet market and trying to encourage the development of a richer Internet Ecosystem in Singapore, but has not been entirely successful, as indicated by the dearth of Tier 2 ISPs. Efforts are being made to lower the barriers to peering including pressuring SingTel to lower their local loop prices by 20%-40% , and by the recent allocation of wireless spectrum to facilitate bypassing SingTel for Local Loops among other things , and through the recent U.S.-Singapore Free Trade Agreement.

Traffic Patterns are exactly the opposite from Japan; 20% of the Singaporean traffic stays within Singapore. The rest goes elsewhere, reflective of the relatively small size of the market and the diversity of the population .

Whether seen as proactive in deregulating or invasive in company affairs, the government has a stake in so many commercial ventures that it wields considerable power in the Singaporean Peering Ecosystem. There was some hesitancy in this community to talk discuss frankly about the Singaporean government role in interconnections.

Emerging Broadband Peering Players. The broadband eyeballs in Singapore are owned by SingTel and StarHub (which acquired the CableVision Cable-based Internet subscribers). There is no incentive for either of these two Tier 1 ISPs to peer freely. We see no emerging competitive Broadband market in Singapore as we see in Japan, nor do we see disruptions as when the cable companies peer openly in the U.S.

Large Scale Network Savvy Content Players. There are few large-scale content companies in Singapore due to several contributing forces: a) the low degree of Internet penetration, and b) the Singaporean government has been very strict relative to Internet content in Singapore. For these reasons the volume of content traffic volume may not be sufficient to explore peering directly with the Tier 2 ISPs. There is one interconnect region in Singapore, and peering is generally accomplished using a state-built (now commercialized) ATM backbone called 1-Net built to facilitate peering between the players and bring Internet access to the broader Singaporean area. Note that 1-Net is no longer perceived as being neutral. There is however a university-sponsored non-profit initiative to facilitate peering across a switch called the Singaporean Open Exchange (SOX) as well as a commercial Internet Exchange Point (Equinix-Singapore).

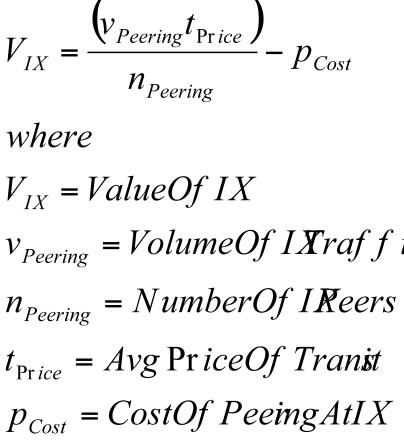

Definition: The Financial Value of an Internet Exchange is a measure of the financial value derived from an IX by its participants. It can be estimated by subtracting the collective cost of participation from the collective benefits of participation (sending that peering traffic over a transit service instead).

Let’s start the analysis by making a three simplifying assumptions.

First, the value an Internet Exchange point provides is facilitating the peering of traffic between participants. There are at least two dimensions to the value of peering: the value of the traffic volume peered, and the routes announced at the IX. We will only focus here on valuing the volume of traffic in this article; the routes announced deserves its own analysis.

Second, it is important to note that several large IXes have both public peering fabrics and private peering services. Private peering is traffic directly exchanged between two parties, often over a physical piece of fiber or a virtual private service. Being able to do both public and private peering represents a significant value of the IX, but unfortunately the traffic peered privately can’t be factored into the analysis since there is no visibility into the amount of traffic exchanged privately. For this reason, we will have to start out with the simplifying assumption that the value of the IX is proportional only to the value of public peering. (The LINX has migrated some large traffic flows onto private peering so as a result this analysis will consequently understate their value.)

Third, let’s assume that the alternative to peering is buying transit, so the value of the IX can be estimated to be

MarketTransitPrice * VolumeOfTrafficPeered

for free at the IX.

Under these assumptions, if the IX went away, the community using the IX would have to exchange that traffic with their transit provider at a metered rate. We further assume that the IX peak measure approximates the 95th percentile measure upon which transit is billed.

We say ‘peered away for free’, but public peering is not completely free. The cost of public peering includes some monthly recurring costs for each participant at the IX. If we subtract these costs from the value derived, we can estimate the value of the IX to the population:

ValueIX = TrafficPeeredAtIX * TransitPrice – CostOfPeering*NumberOfMembers

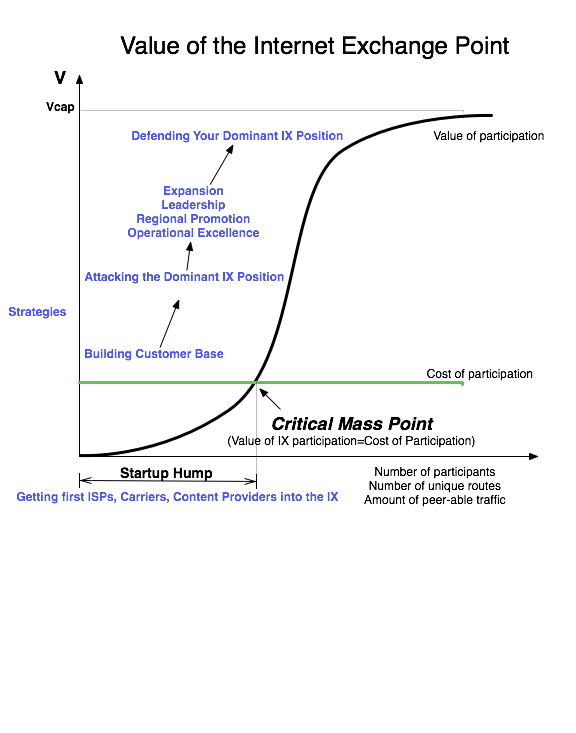

Observation: The Internet Exchange Points exhibit the characteristics of what economists call the “Network Externality Effect”; the value of the product or service is proportional to the number of users of the product or service .

Internet Exchanges are a special case of this effect; the value of an Exchange Point is not the number of participants but a slightly more complex calculation including the number and uniqueness of the routes and volume of traffic peered. Since the value of the IX to an ISP is proportional to the amount of traffic the ISP can exchange in peering relationships at the IX, the value of the IX to the peering population follows the network externality graph as shown below.

On the Y-axis we see the value of the Internet Exchange Point. On the X-axis we see the independent variable that causes the value of the IX to increase; we will use the number of participants for now; as more participants connect to the exchange for peering, the more value an NSP could derive from peering at the IX

All Internet Exchange Points go through the following growth curve. They start out with zero or a few founding ISP members, and face the challenge of attracting additional peers into a building where there are not many peers to peer with. This is the "startup hump", and solutions to this problem were shared with the author in "The Art of Peering: The IX Playbook".

Once the IX reaches critical mass, where the value of participation exceeds the cost of participation, the a well positioned IX experiences exponential growth.

Note: Some variables in this equation may be difficult to obtain.

Many Internet Exchange Points make the aggregate peering traffic volume available to the public, but some do not.

Further, private peering exchanges often utilize cross connects making it impossible to assess the total amount of traffic traversing their private exchange. This formula is therefore more accurately described as the value of a Public Internet Exchange fabric to the participants. To calculate the value of the Internet exchange, one would need to include not only the public peering fabric, but also the benefits of private peering and buying/selling transit in an environment where interconnection cross connects is less expensive than with local loops.

Be sure to chaeck out the Modeling an Internet Exchange Point for a list of the assumptions in this model.

Now we can estimate the value of the Internet Exchange Point, or at least the value of the public peering that we can measure at the Internet Exchange Point.

This Internet Peering Ecosystem has the following Internet Exchange Points:

The SOX is the only real Internet Exchange Point, with the STIX being a transit exchange operated by SingTel.University location.

A few notes about peering and transit in Singapore....

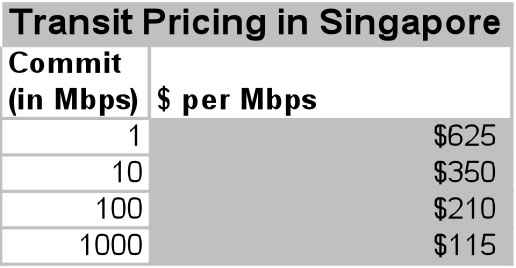

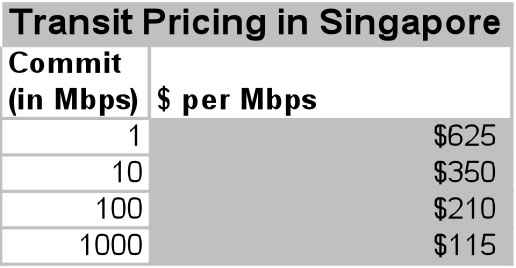

Transit is expensive. A T1 of transit costs $700/Mbps (US$), and the unit price decreases only when a DS3 is purchased yielding a $400-$500/Mbps price point. If you purchase paid peering / transit from the STIX it can cost up to $1400/Mbps (USD) for a 1 Mbps commitment and $892/Mbps-$1200/Mbps for a 10Mbps commitment .

Transit Pricing is Discriminatory. At APRICOT 2004 Peering Track, many people pointed out that the price of transit depends who you are. Within the Singaporean government and among a network of sponsored companies, the price for transit is much lower . Prices for 1Mbps of transit vary from $450/Mbps up to $625/Mbps .

Local Loops are expensive. There is relatively little traffic between Singaporean ISPs, and when combined with the expense of getting into an IX, makes it very difficult to make the business case for Peering. This has led to a very difficult business case for peering (since the cost of getting to a peering point is expensive) as well as making it difficult for ISPs to compete against SingTel using SingTel local loops. The cost of an STM-1 local loop from SingTel or Starhub might cost $9K/month, or from Global Switch or Chai Chee $6K/month , where the same STM-1 in Hong Kong would cost around $4K/month .

The infancy of the Singaporean Internet Ecosystem is reflected in the relatively small # of ISPs, expensive local loops, dominance and lack of aggressive competition among the ISPs. There are only 42 ISPs in Singapore which may be understandable given that it is a small country with only a few million people.

Singaporean Surprises. Among the surprises peering in Singapore, many Peering Coordinators cited the STIX Internet Exchange as a misnomer. The STIX is a SingTel operation that sells transit to various AP countries at a price approaching the price of SingTel transit, which is among the highest transit prices in the world. Further, there is an AS in between the ISP and the “peers” reachable via the STIX. Since most Peering Coordinators see Peering as a Direct, Free and unmetered service, the STIX is seen by many in the Peering Coordinator community as a it service named as an IX.

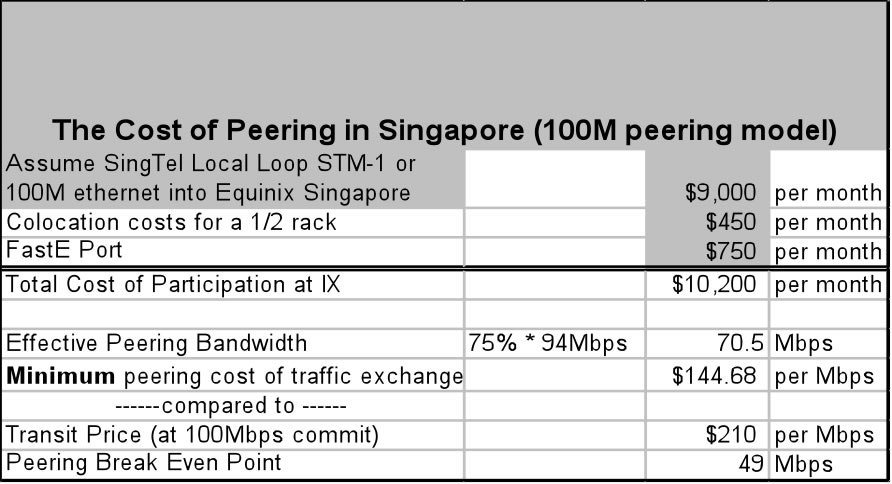

Figure 4 - The Price of Internet Transit in this ecosystem

As stated earlier, Singapore has one of the most expensive transit markets in the region. It also has very expensive local loops, which provide a hurdle for the business case for peering. In fact, the largest component of the business case for peering is the local loop. For example, if an ISP builds into the Equinix Singapore IX using an STM-1, one can assume a local loop cost of $9,000 per month. This represents the largest chunk of the peering costs as shown below.

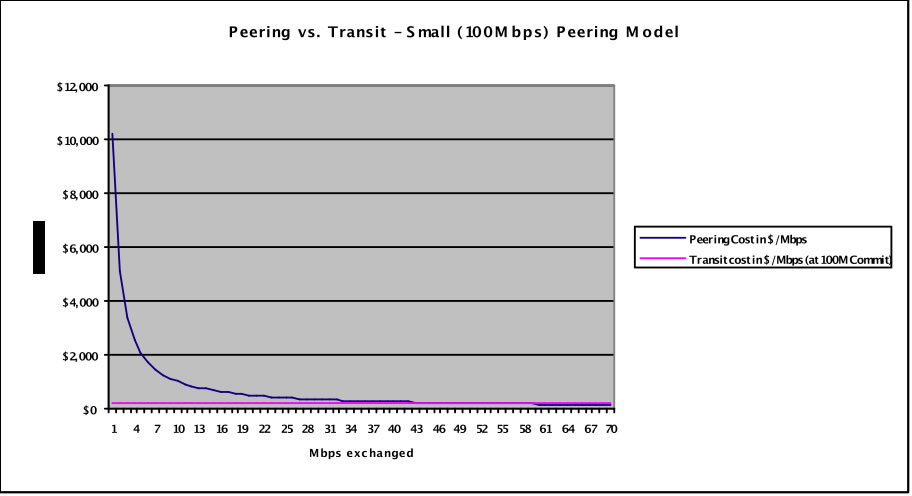

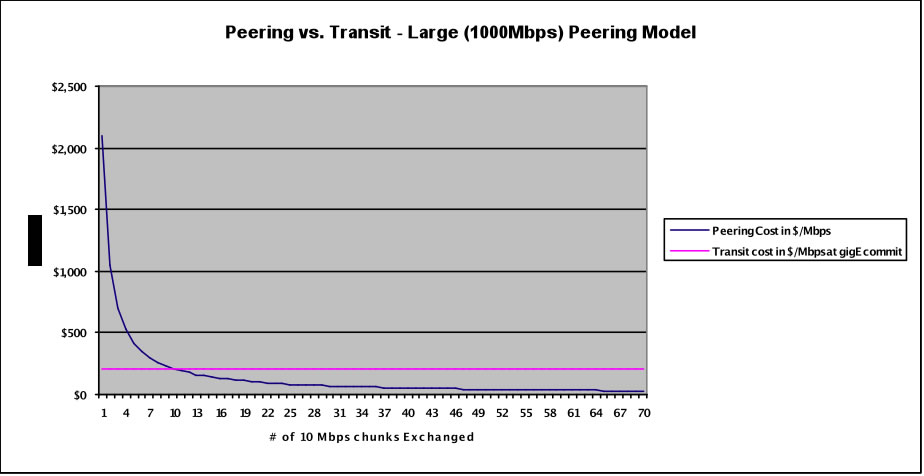

At the same time, expensive transit leads to a strong business case for peering in Singapore. We see in the analysis that the Effective Peering Range is 49 Mbps to 70.5 Mbps. Within this narrow range, peering is less expensive than simply purchasing transit as shown below. A rational ISP would build in if the peering traffic volume is expected to fall within this range, shown graphically below.

Some more explain text. See if we need to add multiple sized pipe peering...

The challenge in Singapore is building critical mass at the IX so that participants can exchange this much traffic. Beyond this 70.5 Mbps, peering capacity must be upgraded.

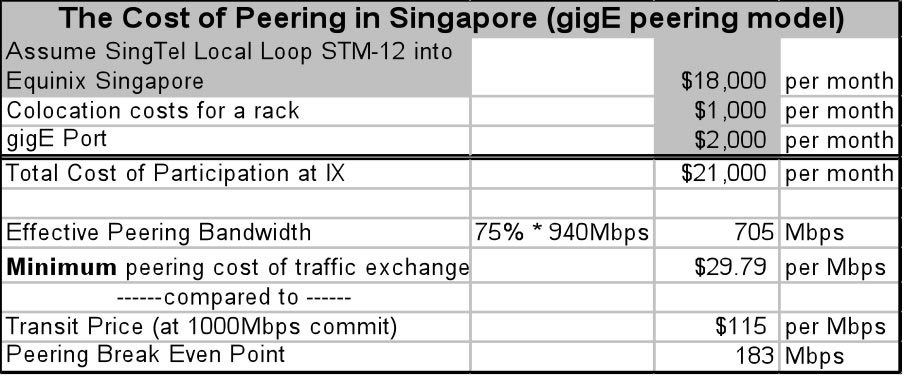

Interviews with players in Singapore indicated that gigabit level peering is not an option in Singapore since there are not many Tier 2 ISP, and maybe none could peer a Gbps of traffic! Just the same, below we provide a guesstimate of the business case for Gigabit peering in Singapore. You can see, once the volume of peering traffic grows, it is quite compelling.

Figure 4 - The Price of Internet Transit in this ecosystem

If one can peer 183 Mbps of traffic in Singapore, then peering is less expensive than transit at the gigabit per second commit levels. One will continue saving money up to the Effective Peering Bandwidth of 705 Mbps where the Minimum cost of Peering approaches $144.68 per Mbps.

Very few ISPs exist in Singapore. It was difficult to obtain prices on higher commits since so few had purchased that much transit.

Domestic Peering Points in Singapore. While these transit prices might lead one to believe that Peering is a reasonable approach to reduce costs, Peering in Singapore is at the very early stages of development. The National University of Singapore and government have backed the Singapore Open Exchange (SOX) for several years with only a handful of takers. Recently Equinix has entered the market launching Private and Public Peering and interconnect environments for peering and transit services as well.

High local loop costs affect both of these Internet Exchange Points in Singapore; the local loops to get into a peering point are expensive (twice the cost of the same transport service in Hong Kong for example ). This leads to a very expensive per Mbps peering cost as compared with transit. It is not surprising that peering points in Singapore have not been widely adopted.